Health insurance offers financial defense from health care expenses by covering some or all of the expenditures of regular and emergency medical care. Many Americans receive health insurance coverage as part of an advantage plan offered by their company, however there may be other alternatives offered if you do not have insurance coverage through a job, or the coverage available to you is too expensive. Maine, Care provides free and low-priced medical insurance and other help paying for healthcare for people who satisfy specific requirements, such as earnings, age, or medical condition. Medicare is a federal program that covers most senior citizens and numerous people with specials needs.

If you do not qualify for Maine, Care you might still be qualified to receive monetary support spending for your health insurance on Health, Care. Gov. The open Registration period currently runs November 1 December 15 of each year. Nevertheless, you may get approved for an Unique Registration Period if you've had certain life events, consisting of losing health coverage, moving, getting married, having a child, or embracing a child. You can also check out Cover, ME.gov for more information. Although organizations with 1-49 employees are not required to offer insurance coverage, many small company owners want to supply their employees with health benefits.

Lots of or all of the items included here are from our partners who compensate us. This might affect which items we compose about and where and how the product appears on a page. Nevertheless, this does not influence our examinations (How to cancel geico insurance). Our viewpoints are our own. Time is normally restricted to choose the finest health insurance prepare for your household, but rushing and choosing the wrong one can be expensive. Here's a start-to-finish guide to choosing the very best prepare for you and your household, whether it's through the federal marketplace or a company. Many people with medical insurance get it through a company.

Essentially, your company is your marketplace. If your company offers medical insurance and you want to browse for an alternative strategy in the exchanges, you can (How much is renters insurance). But strategies in the market are most likely to cost a lot more. This is since most companies pay a part of workers' insurance premiums and because the plans have lower overall premiums, on average. If your task doesn't provide medical insurance, store on your state's public market, if offered, or the federal marketplace to discover the least expensive premiums. Start by going to Health, Care. gov and entering your ZIP code throughout open registration. You'll be sent to your state's exchange if there is one.

The Best Strategy To Use For How Much Car Insurance Do I Need

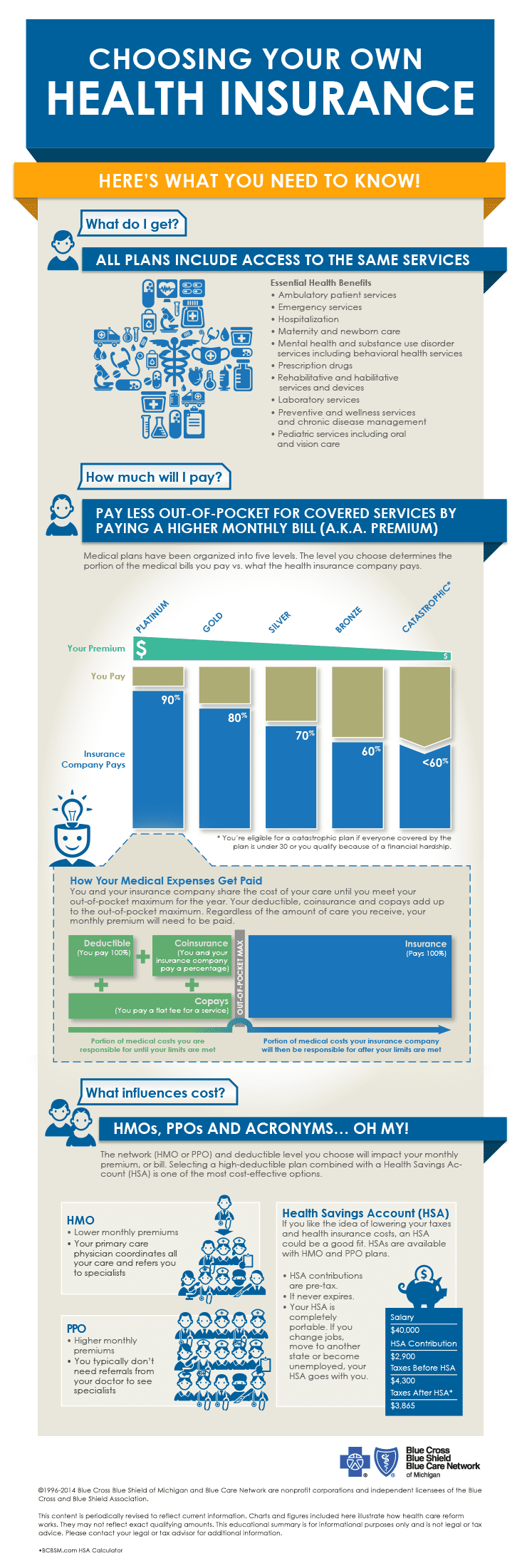

You can also acquire health insurance coverage through a private exchange or directly from an insurer. If you select these alternatives, you won't be qualified for premium tax credits, which are income-based discount rates on your month-to-month premiums. You'll experience some alphabet soup while shopping; the most common kinds of health insurance policies are HMOs, PPOs, EPOs or POS strategies. The kind you pick will assist determine your out-of-pocket costs and which medical professionals you can see. While comparing strategies, search for a summary of benefits. Online markets generally provide a link to the summary and reveal the cost near the plan's title.

If you're going through an employer, ask your work environment benefits administrator for the summary of advantages. When comparing different plans, put your family's medical needs under the microscope. Look at the amount and type of treatment you have actually received in the past. Though it's impossible to anticipate every medical expense, understanding patterns can assist you make a notified choice. If you select an HMO or POS plan, which need recommendations, you typically should see a main care physician before arranging a procedure or visiting a specialist. Because of this requirement, lots of individuals prefer other strategies. Due to the constraints, however, HMOs tend to be the least expensive kind of health plan, overall.

One advantage is that there's less work on your end, since your medical professional's personnel collaborates sees and deals with medical records. If you do select a POS strategy and head out of network, ensure to get the recommendation from your doctor ahead of time to decrease out-of-pocket expenses. If you would rather choose your experts, you may be better with a PPO or an EPO. An EPO may assist keep costs low as long as you discover service providers in network; this is more likely to be the case in a larger city location. A PPO may be better if you reside in a remote or rural area with minimal access to doctors and care, as you may be required to head out of the network.

They are the only plans that qualify you to open an HSA, which is a tax-advantaged account you can utilize to pay health care costs. If you have an interest in this plan, make sure to discover the ins and outs of HSAs and HDHPs first.: HSA vs FSA: What's the distinction? Expenses are lower when you go to an in-network doctor since insurance companies contract lower rates with in-network providers. When you go out of network, those doctors don't have agreed-upon rates, and you're normally on the hook for a greater part of jennifer wesley google the expense. If you have preferred physicians and desire to keep seeing them, make certain they remain in the company directories for the strategy you're thinking about.

Unknown Facts About What Is Insurance Deductible

If you do not have a favored medical professional, search for a plan with a large network so you have more choices. A bigger network is especially essential if you reside in a rural community, since you'll be more most likely to discover a regional doctor who takes your plan. Get rid of any strategies that don't have local in-network medical professionals, if possible, and those with very few service provider choices compared with other strategies. Out-of-pocket expenses are almost as essential as the network. Any plan's summary of benefits need to clearly lay out how much you'll need to pay out of pocket for services. The federal market site uses pictures of these expenses for contrast, as do many state markets.

As the consumer, your part of expenses includes the deductible, copayments and coinsurance. The overall you can invest out of pocket in a year is restricted, and that out-of-pocket maximum is likewise listed in your strategy details. In general, the lower your premium, the greater your out-of-pocket costs. Your objective throughout this step is to narrow down choices based on out-of-pocket costs. A strategy that pays a greater part of your medical costs, but has higher regular monthly premiums, might be better if: You see a main doctor or a specialist often. You frequently require emergency care. You free disney world tickets timeshare presentation take pricey or brand-name medications on a regular basis.